Inheritance Tax Illinois 2025. What are the proposed changes to the illinois estate tax? Use our illinois inheritance tax calculator to estimate inheritance tax on an estate.

Colorado implemented it in 1987. Since illinois is not a state that imposes an inheritance tax, the inheritance tax in 2025 is 0% (zero).

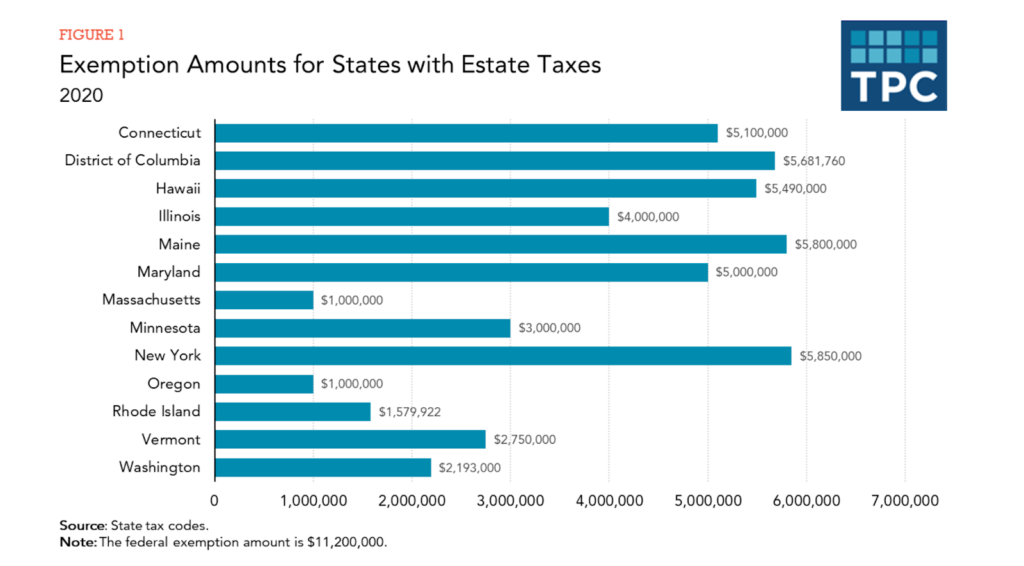

Estate and Inheritance Taxes Urban Institute, If you're a resident of illinois and leave behind more than $4 million (for deaths occurring in 2025), your estate might have to pay illinois estate tax. Since illinois is not a state that imposes an inheritance tax, the inheritance tax in 2025 is 0% (zero).

2025 form il 1040 instructions Fill out & sign online DocHub, Input the estate value and beneficiary relationships to get an instant estimate of your inheritance. Today’s taxa tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general.

Inheritance Tax What It Is, How It's Calculated, and Who Pays It, Published wednesday, february 7, 2025 | source: Furthermore, illinois’ $4 million threshold lags the federal estate tax exemption, which is at $13.6 million, but is scheduled to sunset down to approximately.

:max_bytes(150000):strip_icc()/inheritancetax.asp-final-96944c15e1cc4e17b4b94d7b88eb8cec.jpg)

17 States that Charge Estate or Inheritance Taxes Alhambra Investments, States with no tax on tsps. Increases the exclusion amount to $8,000,000 for persons dying on or after january 1, 2025.

Tax rates for the 2025 year of assessment Just One Lap, Illinois taxes estates valued at $4,000,000 or more. Taxing people's inheritance cannot address inequality and has never removed poverty, indian prime minister narendra modi told the times of india newspaper,.

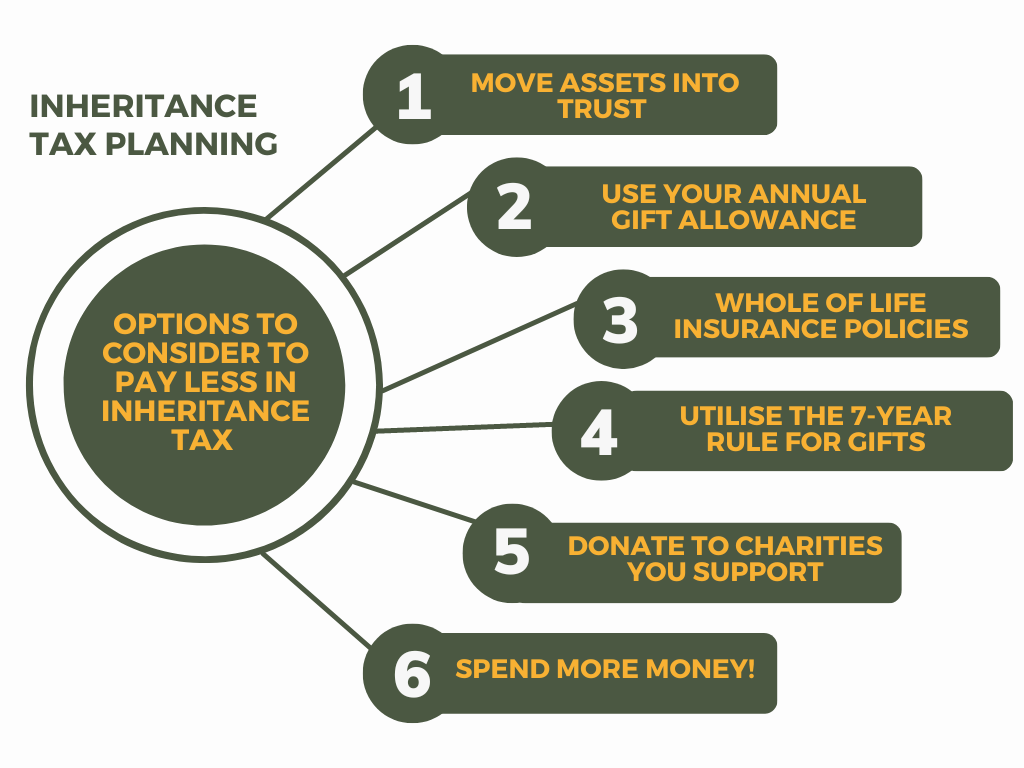

Inheritance Tax Planning Sunny Avenue, Illinois levies no inheritance tax but has its own estate tax. In 2025, the estate and gift tax exemptions will increase again, with the amount of the increate dependent on the level of inflation during 2025.

Is Inheritance Taxable in Illinois? Learn About Law YouTube, The political controversy that has arisen due to comments on inheritance tax is known to all, at least. 31, 2025 at 4:55 pm pst.

All You Need to Now About Inheritance Taxes at Federal and State Level, By goldenpi may 3, 2025 9 views. Tax implications for inheritances in 2025:

How To Lower Illinois Inheritance Tax Orlowsky & Wilson, What are the proposed changes to the illinois estate tax? States with no tax on tsps.

What Should You Do With an Inheritance? Plainfield, IL Patch, 31, 2025 at 4:55 pm pst. January 4, 2025 by steven oakley.